A have a look at the shareholders of Mach7 Applied sciences Restricted (ASX:M7T) can inform us which group is strongest. With 54% stake, establishments possess the utmost shares within the firm. In different phrases, the group stands to realize probably the most (or lose probably the most) from their funding into the corporate.

Since institutional have entry to very large quantities of capital, their market strikes are inclined to obtain loads of scrutiny by retail or particular person buyers. Because of this, a sizeable quantity of institutional cash invested in a agency is usually seen as a optimistic attribute.

Within the chart beneath, we zoom in on the totally different possession teams of Mach7 Applied sciences.

Try our newest evaluation for Mach7 Applied sciences

What Does The Institutional Possession Inform Us About Mach7 Applied sciences?

Many establishments measure their efficiency towards an index that approximates the native market. So that they normally pay extra consideration to corporations which can be included in main indices.

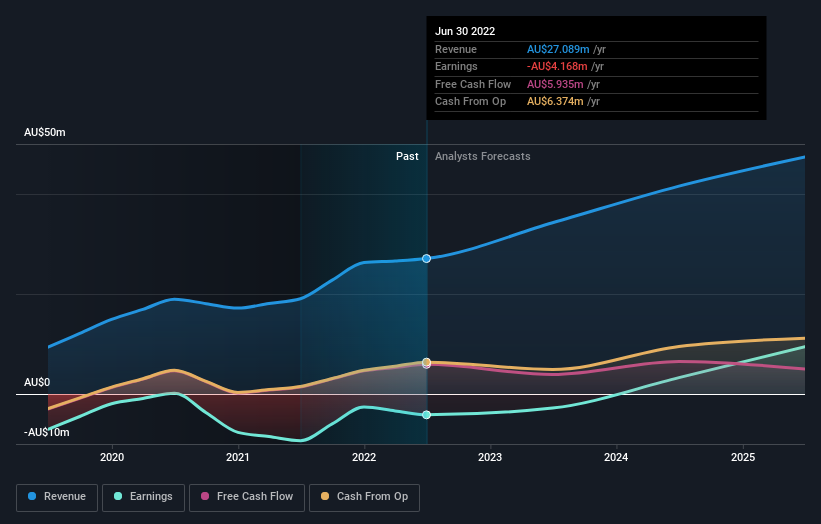

Mach7 Applied sciences already has establishments on the share registry. Certainly, they personal a good stake within the firm. This suggests the analysts working for these establishments have regarded on the inventory and so they prefer it. However similar to anybody else, they may very well be unsuitable. It isn’t unusual to see a giant share value drop if two giant institutional buyers attempt to promote out of a inventory on the similar time. So it’s price checking the previous earnings trajectory of Mach7 Applied sciences, (beneath). After all, needless to say there are different elements to contemplate, too.

Since institutional buyers personal greater than half the issued inventory, the board will possible have to concentrate to their preferences. Mach7 Applied sciences is just not owned by hedge funds. JM Monetary Group is at present the corporate’s largest shareholder with 17% of shares excellent. For context, the second largest shareholder holds about 16% of the shares excellent, adopted by an possession of 11% by the third-largest shareholder.

On trying additional, we discovered that 52% of the shares are owned by the highest 4 shareholders. In different phrases, these shareholders have a significant say within the choices of the corporate.

Researching institutional possession is an effective strategy to gauge and filter a inventory’s anticipated efficiency. The identical will be achieved by learning analyst sentiments. There may be some analyst protection of the inventory, but it surely might nonetheless grow to be extra well-known, with time.

Insider Possession Of Mach7 Applied sciences

The definition of an insider can differ barely between totally different international locations, however members of the board of administrators all the time rely. The corporate administration reply to the board and the latter ought to symbolize the pursuits of shareholders. Notably, typically top-level managers are on the board themselves.

Most take into account insider possession a optimistic as a result of it will probably point out the board is nicely aligned with different shareholders. Nonetheless, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date knowledge signifies that insiders personal some shares in Mach7 Applied sciences Restricted. It has a market capitalization of simply AU$156m, and insiders have AU$8.7m price of shares, in their very own names. This reveals not less than some alignment, however we normally wish to see bigger insider holdings. You possibly can click on right here to see if these insiders have been shopping for or promoting.

Normal Public Possession

Most of the people, who’re normally particular person buyers, maintain a 37% stake in Mach7 Applied sciences. Whereas this group cannot essentially name the pictures, it will probably actually have an actual affect on how the corporate is run.

Personal Firm Possession

Our knowledge signifies that Personal Firms maintain 3.8%, of the corporate’s shares. Personal corporations could also be associated events. Typically insiders have an curiosity in a public firm via a holding in a non-public firm, slightly than in their very own capability as a person. Whereas it is onerous to attract any broad stroke conclusions, it’s price noting as an space for additional analysis.

Subsequent Steps:

Whereas it’s nicely price contemplating the totally different teams that personal an organization, there are different elements which can be much more vital.

I wish to dive deeper into how an organization has carried out previously. You will discover historic income and earnings on this detailed graph.

Should you would like uncover what analysts are predicting by way of future progress, don’t miss this free report on analyst forecasts.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be per full yr annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Enroll right here