Even when a enterprise is shedding cash, it is doable for shareholders to earn a living in the event that they purchase a superb enterprise on the proper worth. For instance, though Amazon.com made losses for a few years after itemizing, in case you had purchased and held the shares since 1999, you’ll have made a fortune. Having stated that, unprofitable firms are dangerous as a result of they might probably burn by means of all their money and grow to be distressed.

Given this threat, we thought we might check out whether or not Volpara Well being Applied sciences (ASX:VHT) shareholders needs to be frightened about its money burn. On this article, we outline money burn as its annual (unfavourable) free money circulate, which is the amount of cash an organization spends annually to fund its progress. We’ll begin by evaluating its money burn with its money reserves as a way to calculate its money runway.

View our newest evaluation for Volpara Well being Applied sciences

Does Volpara Well being Applied sciences Have A Lengthy Money Runway?

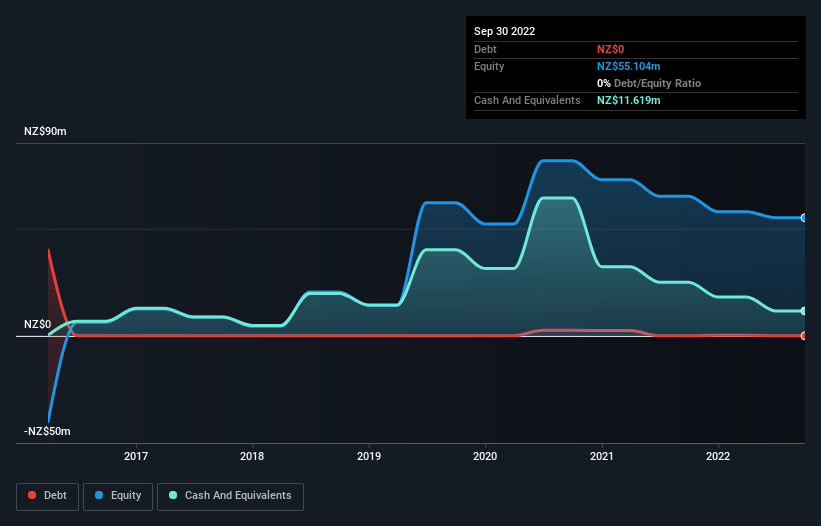

You possibly can calculate an organization’s money runway by dividing the amount of money it has by the speed at which it’s spending that money. When Volpara Well being Applied sciences final reported its steadiness sheet in September 2022, it had zero debt and money value NZ$12m. Within the final 12 months, its money burn was NZ$14m. So it had a money runway of roughly 10 months from September 2022. Importantly, analysts suppose that Volpara Well being Applied sciences will attain cashflow breakeven in round 16 months. Which means until the corporate reduces its money burn rapidly, it might properly look to lift more money. Depicted under, you possibly can see how its money holdings have modified over time.

How Effectively Is Volpara Well being Applied sciences Rising?

Some buyers may discover it troubling that Volpara Well being Applied sciences is definitely rising its money burn, which is up 3.9% within the final 12 months. The excellent news is that working income elevated by 36% within the final 12 months, indicating that the enterprise is gaining some traction. Contemplating the elements above, the corporate doesn’t fare badly on the subject of assessing how it’s altering over time. Whereas the previous is at all times value finding out, it’s the future that issues most of all. For that purpose, it makes loads of sense to try our analyst forecasts for the corporate.

Can Volpara Well being Applied sciences Elevate Extra Money Simply?

Volpara Well being Applied sciences appears to be in a reasonably good place, when it comes to money burn, however we nonetheless suppose it is worthwhile contemplating how simply it might elevate more cash if it needed to. Issuing new shares, or taking over debt, are the commonest methods for a listed firm to lift more cash for its enterprise. Many firms find yourself issuing new shares to fund future progress. We will examine an organization’s money burn to its market capitalisation to get a way for what number of new shares an organization must concern to fund one 12 months’s operations.

Because it has a market capitalisation of NZ$164m, Volpara Well being Applied sciences’ NZ$14m in money burn equates to about 8.5% of its market worth. Given that may be a moderately small proportion, it could most likely be very easy for the corporate to fund one other 12 months’s progress by issuing some new shares to buyers, and even by taking out a mortgage.

How Dangerous Is Volpara Well being Applied sciences’ Money Burn State of affairs?

It might already be obvious to you that we’re comparatively comfy with the way in which Volpara Well being Applied sciences is burning by means of its money. Particularly, we predict its income progress stands out as proof that the corporate is properly on high of its spending. Whereas its money runway wasn’t nice, the opposite elements talked about on this article greater than make up for weak spot on that measure. There isn’t any doubt that shareholders can take loads of coronary heart from the truth that analysts are forecasting it is going to attain breakeven earlier than too lengthy. After taking into consideration the assorted metrics talked about on this report, we’re fairly comfy with how the corporate is spending its money, because it appears on observe to fulfill its wants over the medium time period. An in-depth examination of dangers revealed 1 warning signal for Volpara Well being Applied sciences that readers ought to take into consideration earlier than committing capital to this inventory.

After all, you may discover a implausible funding by wanting elsewhere. So take a peek at this free listing of attention-grabbing firms, and this listing of shares progress shares (in keeping with analyst forecasts)

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Enroll right here