WM Know-how, Inc. (NASDAQ:MAPS), may not be a big cap inventory, but it surely noticed a big share worth rise of over 20% previously couple of months on the NASDAQGS. As a inventory with excessive protection by analysts, you could possibly assume any latest adjustments within the firm’s outlook is already priced into the inventory. Nonetheless, might the inventory nonetheless be buying and selling at a comparatively low-cost worth? As we speak I’ll analyse the newest knowledge on WM Know-how’s outlook and valuation to see if the chance nonetheless exists.

View our newest evaluation for WM Know-how

What’s The Alternative In WM Know-how?

Nice information for traders – WM Know-how remains to be buying and selling at a reasonably low-cost worth in keeping with my worth a number of mannequin, the place I evaluate the corporate’s price-to-earnings ratio to the trade common. On this occasion, I’ve used the price-to-earnings (PE) ratio given that there’s not sufficient info to reliably forecast the inventory’s money flows. I discover that WM Know-how’s ratio of 4.56x is under its peer common of 39.9x, which signifies the inventory is buying and selling at a cheaper price in comparison with the Software program trade. One other factor to bear in mind is that WM Know-how’s share worth is kind of secure relative to the remainder of the market, as indicated by its low beta. Which means in the event you consider the present share worth ought to transfer in the direction of its trade friends, a low beta might recommend it’s not prone to attain that stage anytime quickly, and as soon as it’s there, it might be laborious to fall again down into a pretty shopping for vary once more.

What sort of development will WM Know-how generate?

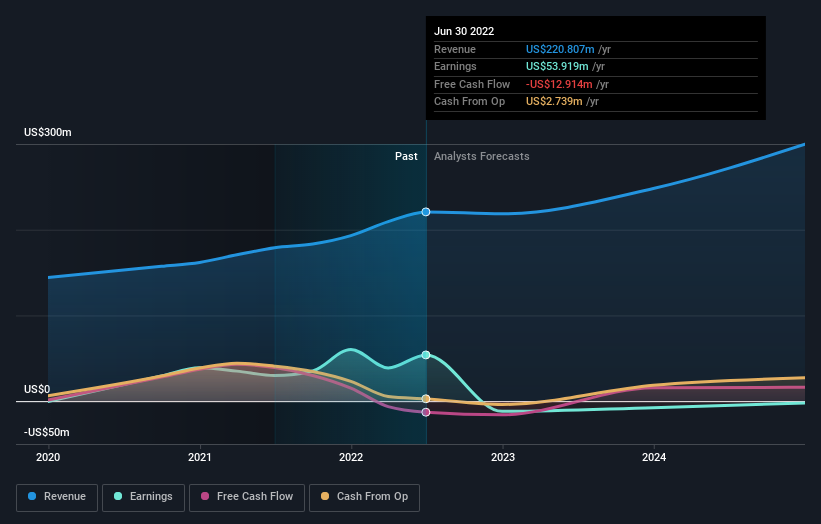

Future outlook is a vital facet whenever you’re wanting to buy a inventory, particularly if you’re an investor searching for development in your portfolio. Shopping for an ideal firm with a sturdy outlook at an inexpensive worth is at all times a great funding, so let’s additionally check out the corporate’s future expectations. Although within the case of WM Know-how, it’s anticipated to ship a extremely unfavorable earnings development within the subsequent few years, which doesn’t assist construct up its funding thesis. It seems that danger of future uncertainty is excessive, at the least within the close to time period.

What This Means For You

Are you a shareholder? Though MAPS is at present buying and selling under the trade PE ratio, the adversarial prospect of unfavorable development brings about some extent of danger. Think about whether or not you need to enhance your portfolio publicity to MAPS, or whether or not diversifying into one other inventory could also be a greater transfer on your whole danger and return.

Are you a possible investor? Should you’ve been maintaining a tally of MAPS for some time, however hesitant on making the leap, I like to recommend you dig deeper into the inventory. Given its present worth a number of, now is a superb time to decide. However be mindful the dangers that include unfavorable development prospects sooner or later.

In gentle of this, if you would like to do extra evaluation on the corporate, it is vital to learn of the dangers concerned. When it comes to funding dangers, we have recognized 3 warning indicators with WM Know-how, and understanding them needs to be a part of your funding course of.

If you’re now not occupied with WM Know-how, you need to use our free platform to see our record of over 50 different shares with a excessive development potential.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Join right here