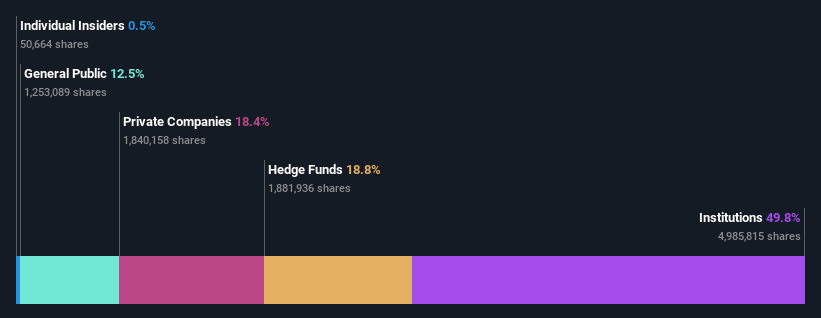

A take a look at the shareholders of Welsbach Know-how Metals Acquisition Corp. (NASDAQ:WTMA) can inform us which group is strongest. The group holding essentially the most variety of shares within the firm, round 50% to be exact, is establishments. In different phrases, the group stands to realize essentially the most (or lose essentially the most) from their funding into the corporate.

Given the huge amount of cash and analysis capacities at their disposal, institutional possession tends to hold a number of weight, particularly with particular person traders. In consequence, a sizeable quantity of institutional cash invested in a agency is usually seen as a optimistic attribute.

Let’s take a more in-depth look to see what the several types of shareholders can inform us about Welsbach Know-how Metals Acquisition.

Take a look at our newest evaluation for Welsbach Know-how Metals Acquisition

What Does The Institutional Possession Inform Us About Welsbach Know-how Metals Acquisition?

Institutional traders generally examine their very own returns to the returns of a generally adopted index. So they typically do take into account shopping for bigger firms which are included within the related benchmark index.

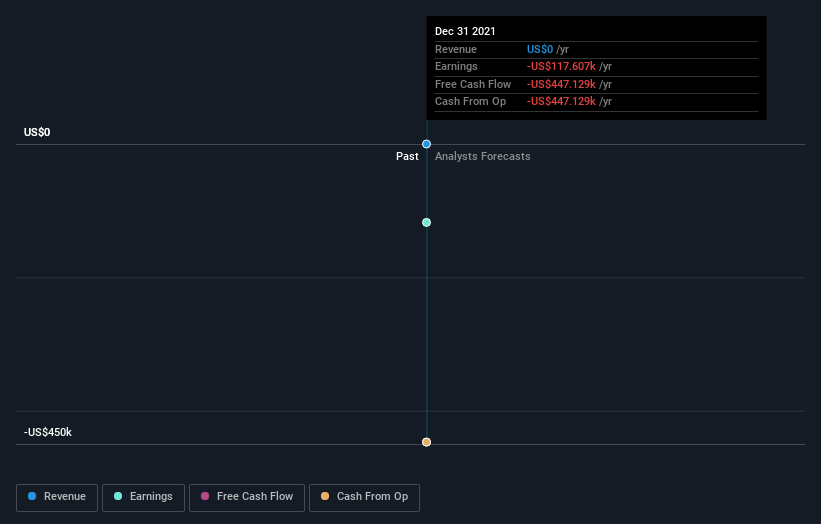

We will see that Welsbach Know-how Metals Acquisition does have institutional traders; and so they maintain a very good portion of the corporate’s inventory. This will point out that the corporate has a sure diploma of credibility within the funding group. Nevertheless, it’s best to be cautious of counting on the supposed validation that comes with institutional traders. They too, get it incorrect typically. When a number of establishments personal a inventory, there’s all the time a danger that they’re in a ‘crowded commerce’. When such a commerce goes incorrect, a number of events might compete to promote inventory quick. This danger is increased in an organization and not using a historical past of development. You may see Welsbach Know-how Metals Acquisition’s historic earnings and income under, however remember there’s all the time extra to the story.

It will seem that 19% of Welsbach Know-how Metals Acquisition shares are managed by hedge funds. That is attention-grabbing, as a result of hedge funds might be fairly energetic and activist. Many search for medium time period catalysts that can drive the share value increased. Our knowledge exhibits that Welsbach Acquisition Holdings LLC is the most important shareholder with 18% of shares excellent. In the meantime, the second and third largest shareholders, maintain 6.5% and 6.3%, of the shares excellent, respectively.

We did some extra digging and located that 7 of the highest shareholders account for roughly 54% of the register, implying that together with bigger shareholders, there are a couple of smaller shareholders, thereby balancing out every others pursuits considerably.

Whereas finding out institutional possession for an organization can add worth to your analysis, it’s also a very good observe to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. We’re not selecting up on any analyst protection of the inventory in the meanwhile, so the corporate is unlikely to be extensively held.

Insider Possession Of Welsbach Know-how Metals Acquisition

The definition of firm insiders might be subjective and does fluctuate between jurisdictions. Our knowledge displays particular person insiders, capturing board members on the very least. Administration finally solutions to the board. Nevertheless, it isn’t unusual for managers to be government board members, particularly if they’re a founder or the CEO.

Most take into account insider possession a optimistic as a result of it may possibly point out the board is properly aligned with different shareholders. Nevertheless, on some events an excessive amount of energy is concentrated inside this group.

Our knowledge means that insiders personal below 1% of Welsbach Know-how Metals Acquisition Corp. in their very own names. However they might have an oblique curiosity via a company construction that we’ve not picked up on. It has a market capitalization of simply US$100m, and the board has solely US$506k price of shares in their very own names. Many are likely to favor to see a board with greater shareholdings. A very good subsequent step may be to check out this free abstract of insider shopping for and promoting.

Basic Public Possession

Most of the people– together with retail traders — personal 13% stake within the firm, and therefore cannot simply be ignored. Whereas this group cannot essentially name the photographs, it may possibly actually have an actual affect on how the corporate is run.

Non-public Firm Possession

Our knowledge signifies that Non-public Firms maintain 18%, of the corporate’s shares. It is laborious to attract any conclusions from this reality alone, so its price wanting into who owns these personal firms. Typically insiders or different associated events have an curiosity in shares in a public firm via a separate personal firm.

Subsequent Steps:

Whereas it’s properly price contemplating the totally different teams that personal an organization, there are different elements which are much more vital. Take dangers for instance – Welsbach Know-how Metals Acquisition has 3 warning indicators (and a pair of which do not sit too properly with us) we predict it is best to find out about.

After all this might not be the perfect inventory to purchase. So take a peek at this free free record of attention-grabbing firms.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which seek advice from the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be according to full 12 months annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Join right here