The large shareholder teams in RLX Expertise Inc. (NYSE:RLX) have energy over the corporate. Usually talking, as an organization grows, establishments will enhance their possession. Conversely, insiders usually lower their possession over time. I fairly wish to see no less than a bit little bit of insider possession. As Charlie Munger mentioned ‘Present me the inducement and I’ll present you the result.

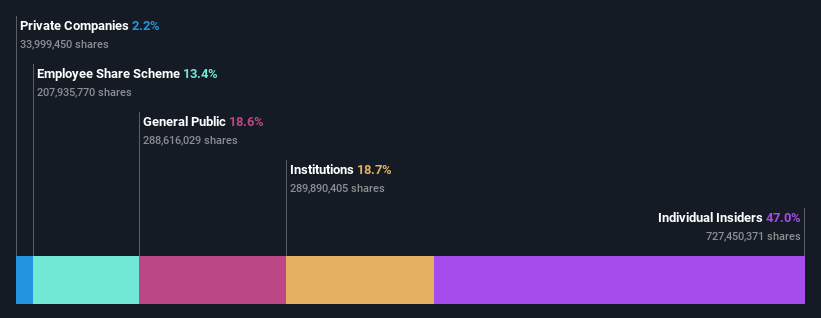

RLX Expertise is a reasonably large firm. It has a market capitalization of US$3.3b. Usually establishments would personal a good portion of an organization this measurement. Within the chart under, we are able to see that establishments personal shares within the firm. We will zoom in on the completely different possession teams, to be taught extra about RLX Expertise.

View our newest evaluation for RLX Expertise

What Does The Institutional Possession Inform Us About RLX Expertise?

Establishments usually measure themselves towards a benchmark when reporting to their very own traders, in order that they usually turn into extra enthusiastic a couple of inventory as soon as it is included in a serious index. We might anticipate most firms to have some establishments on the register, particularly if they’re rising.

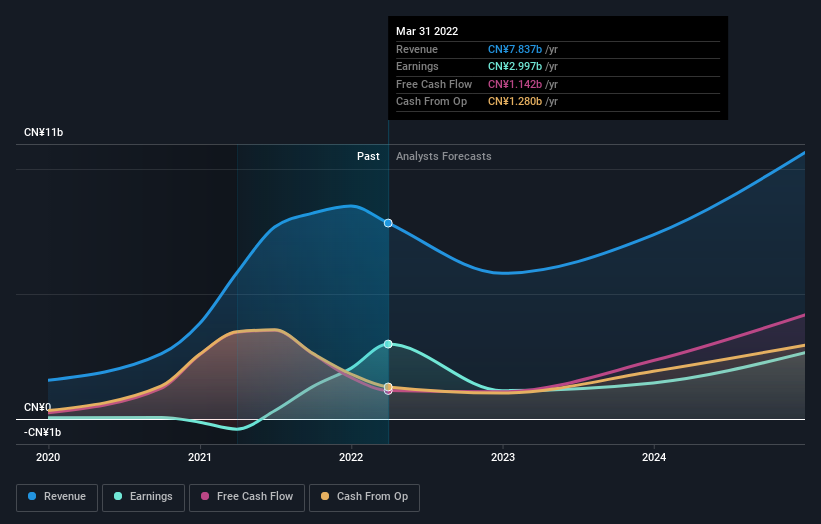

RLX Expertise already has establishments on the share registry. Certainly, they personal a good stake within the firm. This suggests the analysts working for these establishments have appeared on the inventory they usually prefer it. However similar to anybody else, they might be mistaken. If a number of establishments change their view on a inventory on the identical time, you might see the share value drop quick. It is due to this fact price RLX Expertise’s earnings historical past under. After all, the longer term is what actually issues.

Hedge funds do not have many shares in RLX Expertise. The corporate’s CEO Wang Ying is the biggest shareholder with 22% of shares excellent. With 13% and 9.3% of the shares excellent respectively, RLX Expertise Inc.,Share Incentive Plan and Charlie Cao are the second and third largest shareholders.

To make our research extra attention-grabbing, we discovered that the highest 4 shareholders management greater than half of the corporate which means that this group has appreciable sway over the corporate’s decision-making.

Whereas learning institutional possession for a corporation can add worth to your analysis, it’s also an excellent observe to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. Fairly a couple of analysts cowl the inventory, so you might look into forecast development fairly simply.

Insider Possession Of RLX Expertise

The definition of firm insiders will be subjective and does fluctuate between jurisdictions. Our information displays particular person insiders, capturing board members on the very least. The corporate administration reply to the board and the latter ought to symbolize the pursuits of shareholders. Notably, typically top-level managers are on the board themselves.

Most take into account insider possession a constructive as a result of it will probably point out the board is nicely aligned with different shareholders. Nonetheless, on some events an excessive amount of energy is concentrated inside this group.

It appears insiders personal a big proportion of RLX Expertise Inc.. Insiders personal US$1.6b price of shares within the US$3.3b firm. That is fairly significant. It’s good to see this degree of funding. You possibly can verify right here to see if these insiders have been shopping for lately.

Basic Public Possession

Most of the people– together with retail traders — personal 19% stake within the firm, and therefore cannot simply be ignored. Whereas this measurement of possession is probably not sufficient to sway a coverage determination of their favour, they will nonetheless make a collective impression on firm insurance policies.

Subsequent Steps:

It is at all times price fascinated about the completely different teams who personal shares in an organization. However to know RLX Expertise higher, we have to take into account many different elements. To that finish, you have to be conscious of the 1 warning signal we have noticed with RLX Expertise .

In case you are like me, you might wish to take into consideration whether or not this firm will develop or shrink. Fortunately, you possibly can verify this free report exhibiting analyst forecasts for its future.

NB: Figures on this article are calculated utilizing information from the final twelve months, which seek advice from the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not in step with full 12 months annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We purpose to convey you long-term targeted evaluation pushed by elementary information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.